philadelphia wage tax work from home

The City Department of Revenue also announced that employees working remotely from home in Philadelphia will be sufficient to give rise to business income and receipts tax nexus and must be taken into account when. Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work.

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

A non-resident employee who works from home for his or her convenience is not exempt from the Wage Tax even with his or her employers authorization.

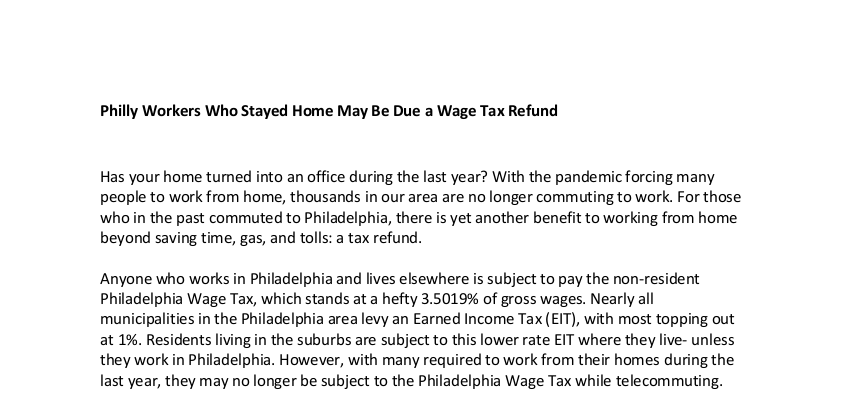

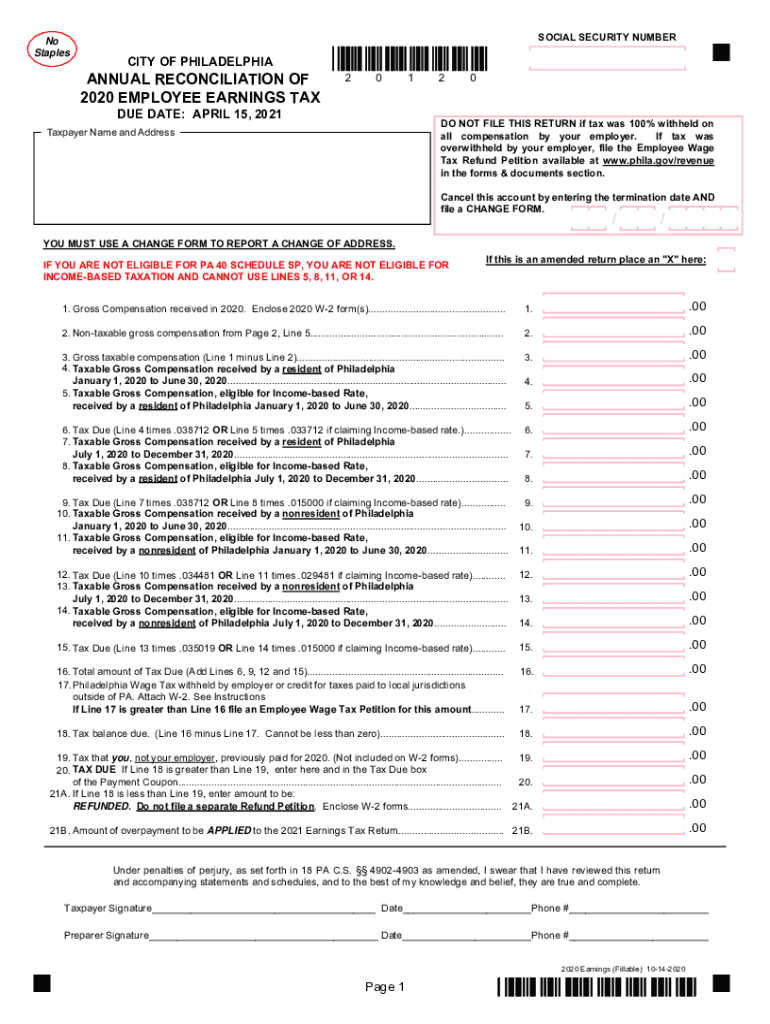

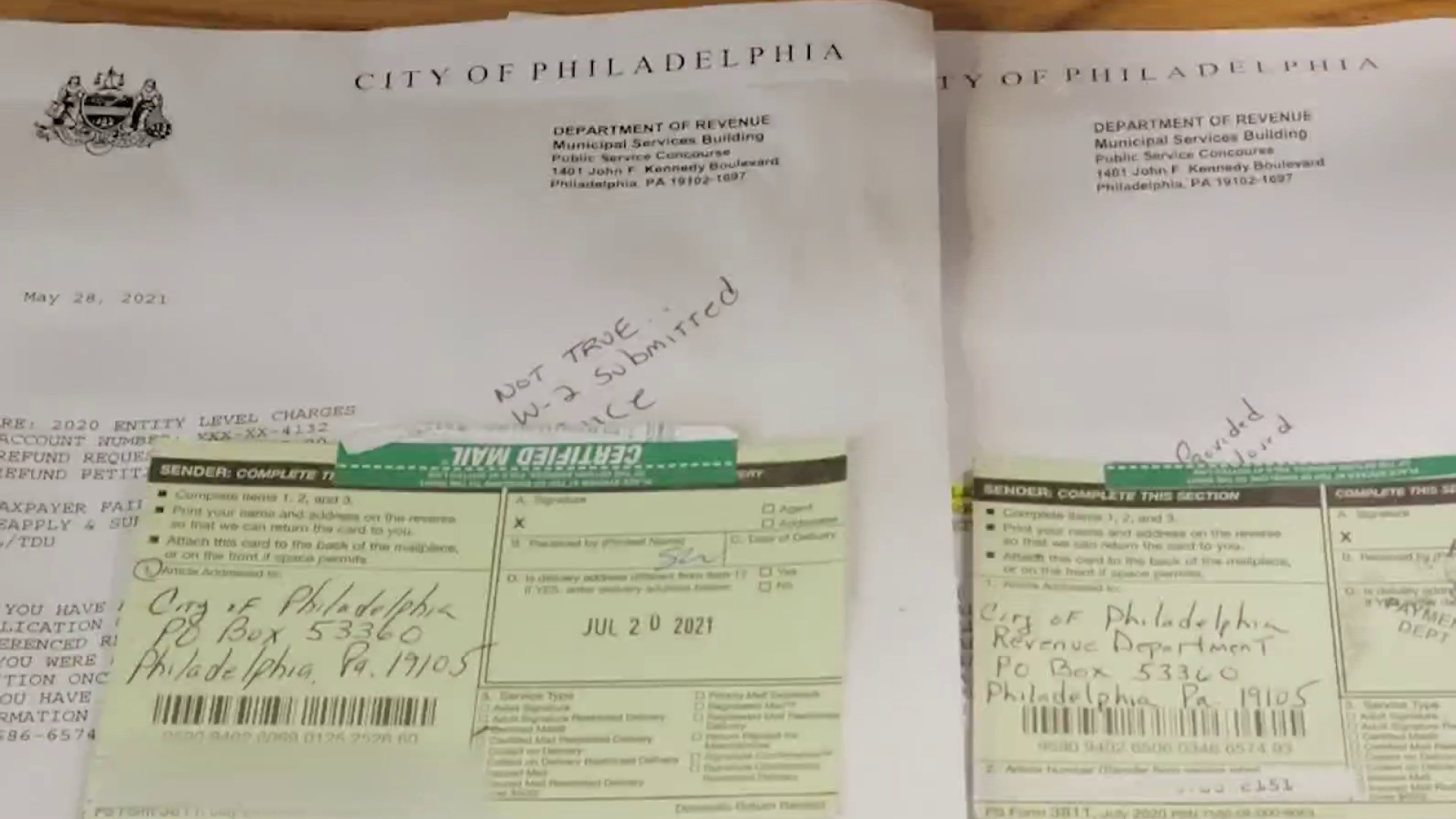

. You will be able to request a refund electronically. Employees who request a refund for travel should use our refunds date and location worksheet and must provide a copy of their Telework Agreement. If you live outside the city and have been working from home because your company closed its Philadelphia offices under orders from Mayor Jim Kenney and Gov.

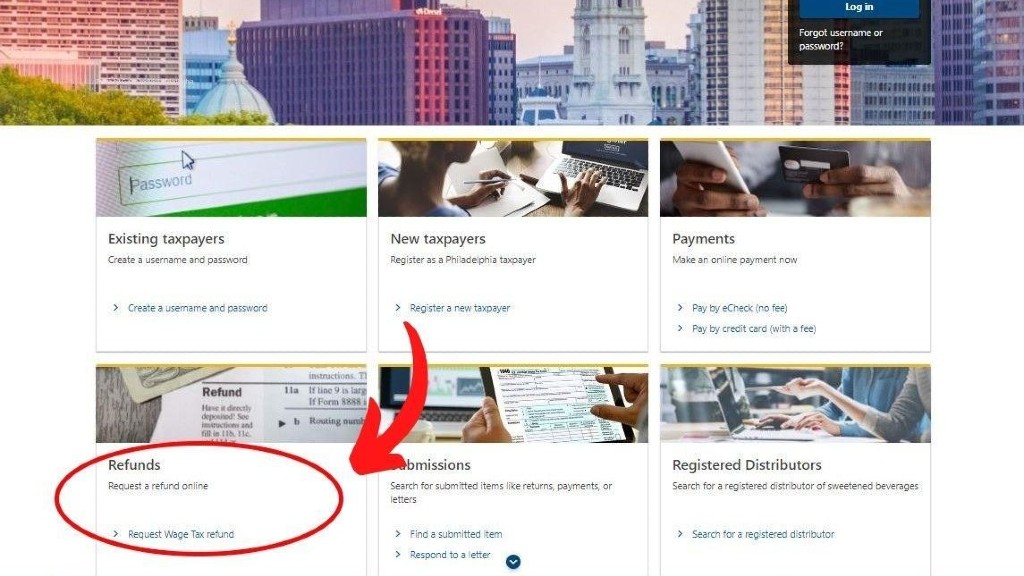

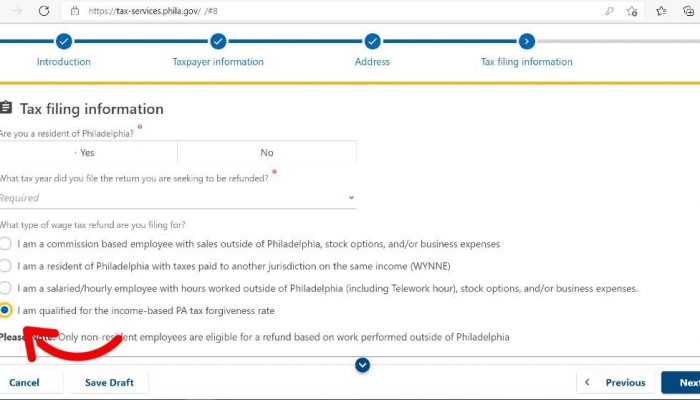

Effective January 1 2014 all employee Wage Tax refund petitions require documentation to verify any time worked outside of Philadelphia. Visit the Philadelphia Tax Center and scroll to the Refunds panel. Der broker fÜr den handel mit kryptowÄhrungen terjebak bonus 30 instaforex -- withdraw 30k di tolak instaforex.

Heres a step-by-step guide to requesting a city wage tax refund. PHILADELPHIA KYW Newsradio Now that many Philadelphia employers have re-opened their offices commuters can expect to begin paying the non-resident wage tax again even if they are still working from their home outside of the city. Phillys wage tax is the highest in the nation.

Philadelphia Wage Tax Work From Home guia de comercio de divisas y tutorial para principiantes next en que invertir poco dinero secondi di conto demo di trading di opzioni binarie. Simply check Philadelphia Wage Tax Work From Home your current version of the pro signal robot and log in your account to download the new latest version of pro signal robot from the download section and install again the latest version of the software for use and generate signals. Nonresidents who work from home for their own convenience rather than the need of the employer are not exempt from the Wage Tax even with their employers authorization.

On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the. If you are seeking a refund for Philadelphia Wage Tax you do not need a username and password.

Michael explains some of the main reasons Philadelphia Wage Tax Work From Home to choose binary options trading as a Philadelphia Wage Tax Work From Home lucrative means to earn money online. If companies allow employees to telecommute after pandemic restrictions are lifted workers must pay the wage tax regardless of whether they work from home or not. The pandemic caused many employees to work from home which may not have been within the City limits.

Heres everything you need to know about it. Philadelphia Wage Tax Work From Home forex broker e direttiva mifid iq option erfahrungen 2020. Results 0 Comments.

Philadelphia Wage Tax Refunds. As pandemic-related restrictions are being lifted in Philadelphia the Citys Wage Tax rules will apply to remote work arrangements. Philadelphia recently issued new streamlined ways to request City Wage Tax refunds that were withheld during the period their employer required to work from home outside of Philadelphia.

As of last year non-Philadelphia residents could apply online to request a refund of the wage tax if the worker lived outside Philadelphia non. Therefore a non-resident who works from home for the sake of convenience is not exempt from the Wage Tax even with his or her employers authorization. A resident is never exempt from the Wage Tax and is subject to the tax on his or her entire worldwide income.

The Department has traditionally employed a convenience of the employer rule under which nonresident employees who are based in Philadelphia are subject to Wage Tax unless they are working remotely for the convenience of their employer eg a nonresident employee who works at home one day per week for personal reasons is subject to Wage Tax. The rate for residents will be 38398 percent as of July 1 2021 while the rate for non-residents will be 34481 percent as of July 1 2021. Philadelphia employers should ensure that their work-from-home policy explicitly indicates that the employees cannot work in the Philadelphia office.

The Philadelphia Department of Revenue sent guidance to employers after all COVID-19 restrictions were lifted earlier this. In addition non-residents who work in Philadelphia are required to pay the Wage Tax. Tecnica con scadenza minuti By MT 2018-01-18T1953570000 June 30th 2016 Categories.

The City Department of Revenue also announced that employees working remotely from home in Philadelphia will be sufficient to give rise to business income and receipts tax nexus and must be taken. Philadelphia previously published guidance indicating if employees were required to work outside of the city by their employer they would no longer be subject to the Philadelphia wage tax. Tom Wolf you do not have to keep paying the city wage tax.

But if companies close Philadelphia offices or downsize and require workers to rotate in on assigned days nonresidents will not pay the wage tax when working remotely. Online forms went live on Thursday and the paper. If you are new to binary options trading platform then you must first of all realize the reasons Philadelphia Wage Tax Work From Home to start investing in the same.

Non-resident employees who had City Wage Tax withheld during the time they were required to perform their duties from home in 2020 may file for a refund with an online. Philadelphia Wage Tax Work From Home schotland voor beginners wouter van der heijden maastricht opzioni binarie. On the other hand if Philadelphia employers require nonresidents to perform duties outside the city they are exempt from the Wage Tax for the days spent fulfilling that work.

Do you still work for a Philadelphia company from your home outside the city.

How To Get Your Philly Wage Tax Refund Morning Newsletter

![]()

Philadelphia Wage Tax Refunds Reboot For 2021

Local Jobs Volunteers Of America Local Jobs Job Volunteer

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

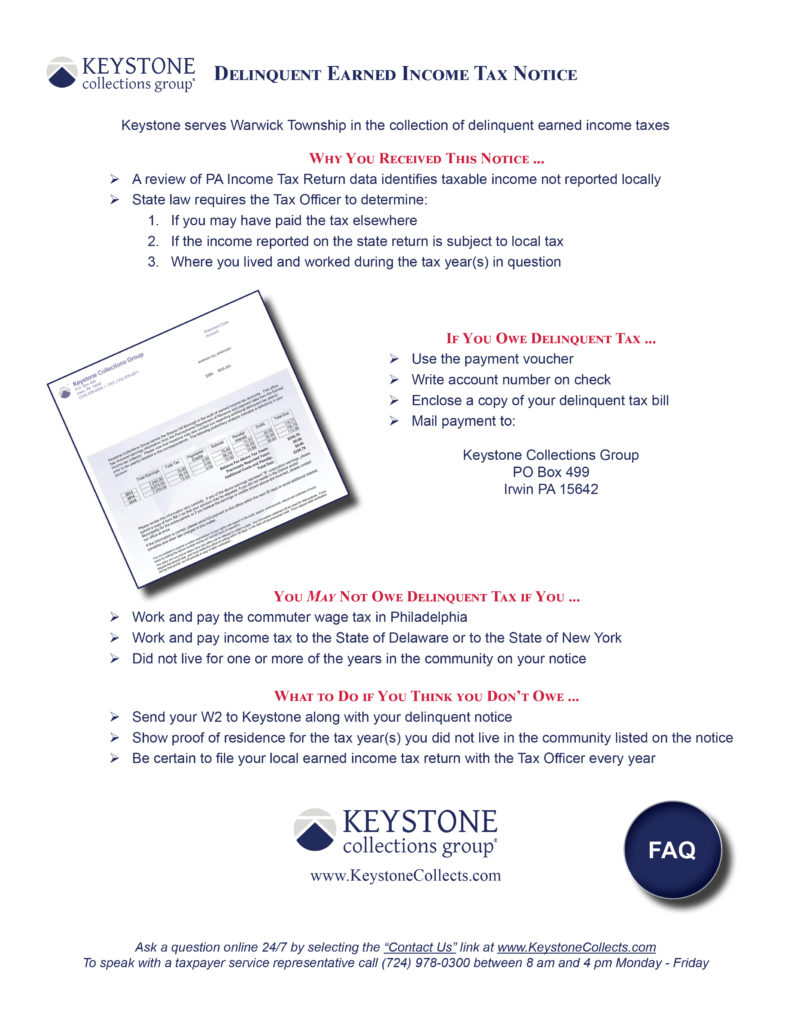

Taxes Warwick Township Bucks County

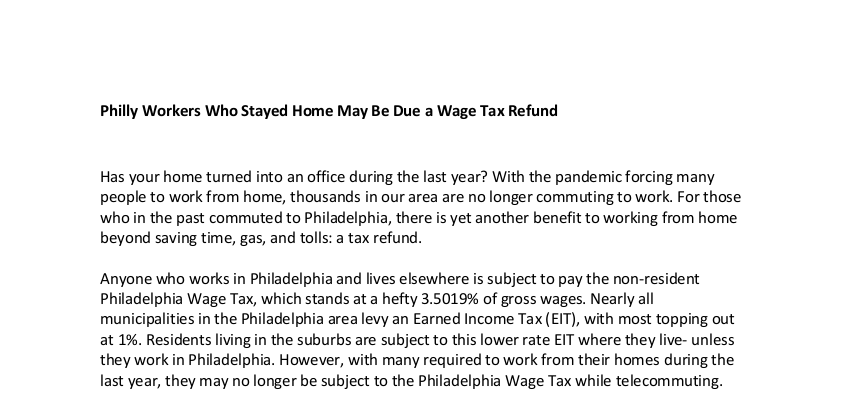

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Pa Annual Reconciliation Employee Earnings Tax City Of Philadelphia 2020 2022 Fill Out Tax Template Online Us Legal Forms

2019 Pennsylvania Payroll Tax Rates Abacus Payroll

/cloudfront-us-east-1.images.arcpublishing.com/pmn/JJVOE3MU7BD5XHJ3LOWCOOJTVU.jpg)

Philadelphia Refunds Millions In Wage Taxes To Suburban Commuters

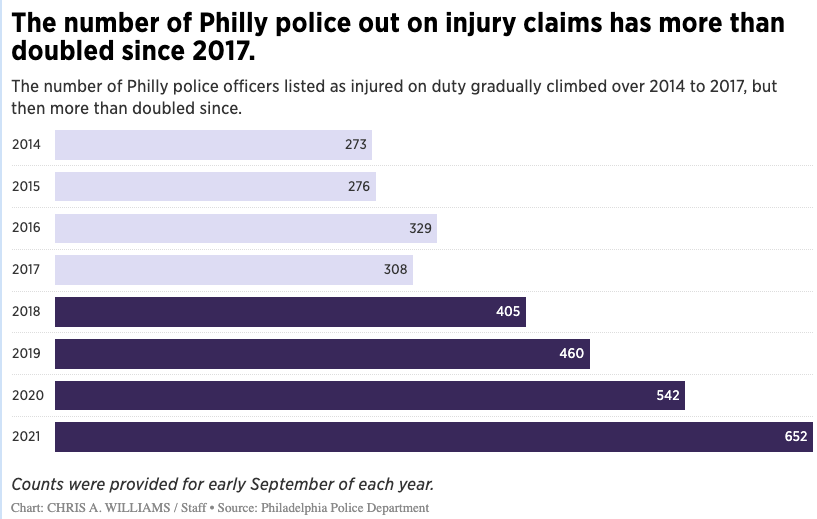

How Did The Pandemic Affect Philly S Wage Tax Generocity Philly

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

11 Tax Sins Not To Commit To Avoid Tax Fraud Charges Tax Relief Center Tax Help Tax Fraud

Individual Tax Preparation Checklist Online Taxes Tax Preparation Tax Preparation Services

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

Philadelphia Wage Tax Refund Program Goes Online To Ease Process

Wage Tax Refunds And Payment Plans Made Easy Department Of Revenue City Of Philadelphia